Beyond Delays: The Full Spectrum of Benefits in Travel Insurance

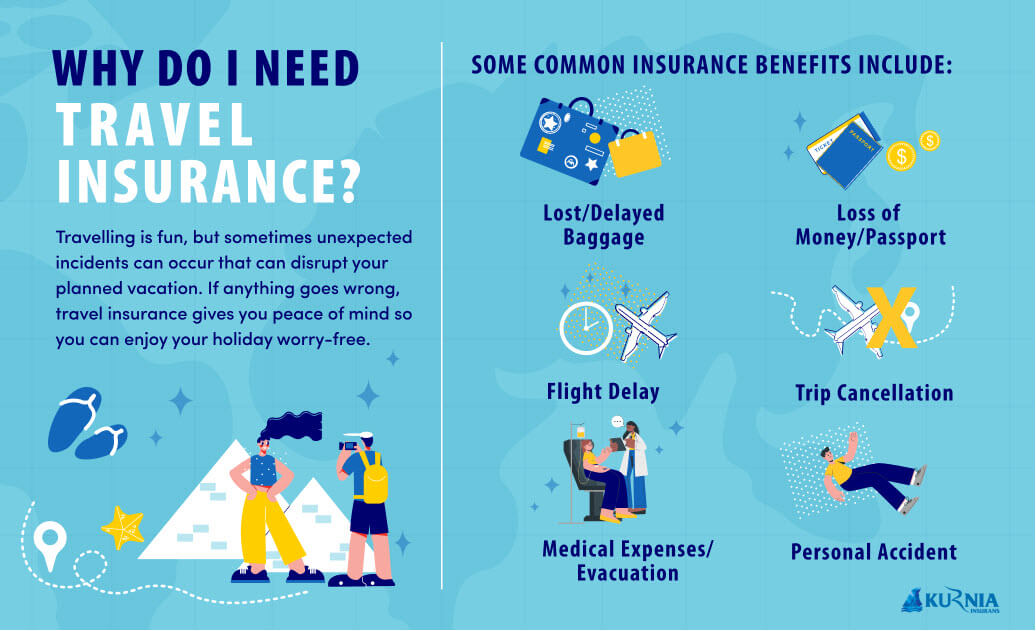

Travel insurance is often overlooked or seen as an unnecessary expense by many travelers. However, beyond the obvious protection against flight delays and cancellations, travel insurance offers a wide range of benefits that can provide peace of mind and financial security during your journeys. In this comprehensive blog article, we will delve into the lesser-known advantages of travel insurance, shedding light on the full spectrum of benefits it offers.

Section 1: Medical Coverage Abroad

Protecting Your Health and Finances

Explore the extensive medical coverage provided by travel insurance policies, including emergency medical expenses, hospitalization, and repatriation. When traveling abroad, unexpected illnesses or accidents can occur, and medical expenses in a foreign country can be exorbitant. Travel insurance ensures that you have access to quality healthcare without worrying about the financial burden. Whether it's a minor ailment or a serious medical emergency, travel insurance covers the costs of doctor visits, hospital stays, surgeries, medications, and emergency medical transport to ensure you receive the necessary care.

Peace of Mind in Unfamiliar Medical Settings

Traveling to a foreign country often means navigating unfamiliar healthcare systems and language barriers. With travel insurance, you gain access to assistance services that can help you find local doctors or hospitals, arrange appointments, and even provide translation services if needed. This support ensures that you receive appropriate care and understand your medical situation, offering peace of mind during a potentially stressful time.

Repatriation: Bringing You Home

In case of a severe medical emergency, travel insurance provides coverage for the cost of repatriation. This includes arranging and covering the expenses of your return journey to your home country, ensuring you receive the necessary medical care and support in a familiar environment. Repatriation can involve complicated logistics and high costs, but travel insurance ensures that you can focus on your recovery without worrying about the financial implications.

Section 2: Trip Interruption and Cancellation Protection

Safeguarding Your Travel Investment

Learn how travel insurance safeguards your investment by providing coverage for unexpected trip interruptions or cancellations. Life is unpredictable, and various circumstances can force you to alter or cancel your travel plans. Whether it's a personal emergency, natural disaster, or unforeseen events like terrorism or political unrest, travel insurance offers protection against financial losses. If you have to cancel your trip before departing or interrupt it once you've started, travel insurance can reimburse you for non-refundable expenses such as flights, accommodations, and prepaid activities.

Unforeseen Personal Emergencies

Travel insurance not only covers trip cancellations or interruptions due to personal emergencies but also provides assistance during these challenging times. Whether it's the sudden illness of a loved one, a family emergency, or a legal obligation, travel insurance can offer support and guidance in rearranging your travel plans or handling the situation. Having travel insurance ensures that you don't have to bear the emotional and financial burden alone.

Protection Against Natural Disasters and Unforeseen Events

One of the often-overlooked benefits of travel insurance is the coverage it provides in cases of natural disasters, such as hurricanes, earthquakes, or severe weather conditions, which can disrupt your travel plans. Additionally, travel insurance may offer protection in case of unforeseen events like terrorism or political unrest, which may make your destination unsafe for travel. With travel insurance, you can be reimbursed for non-refundable expenses and receive assistance in rearranging your plans to avoid potential risks.

Section 3: Baggage and Personal Belongings Coverage

Protection Against Loss, Damage, or Theft

Uncover the protection offered by travel insurance against lost, damaged, or stolen luggage and personal belongings. Regardless of how careful you are, luggage mishaps can happen during your travels, leading to stress and inconvenience. Travel insurance provides coverage for the replacement or repair costs of lost or damaged luggage, ensuring you can continue your journey without disruptions. Additionally, it may also cover the theft of personal belongings, such as passports, laptops, or cameras, offering financial reimbursement for these valuable items.

Delayed Baggage Assistance

Travel insurance doesn't just provide coverage for lost or damaged luggage but also offers assistance in case of delayed baggage. If your luggage is delayed for a certain period, travel insurance can provide reimbursement for essential items like clothing, toiletries, and other necessities that you need to purchase during the delay. This benefit helps you maintain your comfort and continue your trip smoothly, even if your luggage arrives late.

Valuable Reimbursement Options

When it comes to reimbursement for lost, damaged, or stolen belongings, travel insurance offers various options. Some policies reimburse you based on the actual cash value of the item at the time of loss, while others provide replacement cost coverage, ensuring you receive the amount necessary to replace the item with a similar one. Understanding these reimbursement options helps you choose a policy that best suits your needs and ensures you can recover the value of your belongings.

Section 4: Emergency Evacuation and Assistance

Comprehensive Emergency Support

Delve into the crucial aspect of emergency evacuation and assistance provided by travel insurance. In case of unforeseen emergencies, such as natural disasters, political unrest, or medical emergencies, travel insurance offers comprehensive support and coordination services. This includes arranging and covering the costs of emergency medical transport, such as air ambulances or medical repatriation, to ensure you receive the necessary care in a timely manner.

24/7 Emergency Hotline

Travel insurance often provides access to a 24/7 emergency hotline staffed by trained professionals who can assist you in navigating emergency situations. Whether you need medical advice, guidance on local resources, or help in coordinating emergency services, the hotline is there to provide immediate assistance, ensuring you receive the support you need, regardless of the time or location.

Coordination of Services

In situations requiring emergency evacuation or medical treatment, travel insurance takes care of the logistics and coordination. From arranging transportation to finding appropriate healthcare facilities, travel insurance ensures that you receive timely and efficient assistance. This coordination can be particularly valuable in unfamiliar environments where language barriers or lack of local knowledge may impede your ability to access the necessary services.

Travel Assistance in Non-Medical Emergencies

While medical emergencies are a primary focus, travel insurance also offers assistance in non-medical emergencies. From providing guidance in case of legal issues or lost travel documents to helping you navigate unexpected travel disruptions, such as strikes or civil unrest, travel insurance ensures you have a support system to rely on in times of crisis.

Section 5: Coverage for Adventure Activities

Thrilling Adventures with Peace of Mind

For adventure enthusiasts, this section explores the travel insurance benefits that cover a wide range of adventure activities, ensuring you can partake in thrilling experiences with confidence and security. Whether you're into hiking, scuba diving, bungee jumping, or any other adrenaline-pumping activity, travel insurance can provide coverage for accidents, injuries, or emergencies that may occur during these activities. This coverage allows you to fully enjoy your adventure, knowing that you are protected in case of unforeseen circumstances.

Specialized Coverage for Extreme Sports

Some adventure activities are considered more extreme or high-risk, requiring specialized coverage. Travel insurance can offer tailored policies that specifically cater to these activities, providing comprehensive protection. From mountaineering to skydiving, you can find insurance that covers the unique risks associated with your chosen adventure, ensuring you can pursue your passion safely.

Emergency Rescue and Medical Evacuation

In addition to coverage for accidents or injuries during adventure activities, travel insurance also includes provisions for emergency rescue and medical evacuation. If you find yourself in a remote location or facing a life-threatening situation, travel insurance can arrange and cover the costs of rescue operations and medical transport to the nearest adequate healthcare facility. This benefit is particularly crucial during adventure trips where access to immediate medical care may be limited.

Section 6: Rental Car Protection

Coverage for Rental Car Damages

Discover how travel insurance can provide coverage for rental car damages or theft, saving you from exorbitant expenses and potential legal complications during your travels. Renting a car in a foreign country can be convenient, but accidents or theft can happen, leaving you liable for the damages. With travel insurance, you can be reimbursed for the costs of repairs or replacement of the rental car, ensuring that you don't bear the financial burden alone.

Protection Against Additional Charges

In addition to coverage for damages, travel insurance may also protect you against additional charges imposed by the rental car company. For example, if the rental car is rendered unusable due to an accident, the rental company may charge you for the loss of rental income. Travel insurance can cover these charges, ensuring that you are not held responsible for costs beyond your control.

Peace of Mind During Car Rentals

By including rental car protection in your travel insurance policy, you can have peace of mind when renting a car. Even if you are a cautious driver, accidents can happen, and rental car theft is an unfortunate reality in some destinations. Having travel insurance coverage for rentalcar damages or theft means that you can enjoy your road trips without constantly worrying about the potential financial implications of an unexpected incident. It allows you to explore new destinations and navigate unfamiliar roads with confidence, knowing that you have the necessary protection in place.

Section 7: Travel Assistance Services

24/7 Access to Helplines

Explore the valuable travel assistance services provided by travel insurance, including 24/7 helplines staffed by knowledgeable professionals. Whether you need help with travel arrangements, guidance in navigating a medical emergency, or advice on local customs and regulations, these helplines are available to provide immediate support. Having access to experts who can provide timely assistance can be invaluable in ensuring a smooth and stress-free travel experience.

Travel Advice and Information

Travel insurance often offers a wealth of information and advice to help you make the most of your trip. From destination guides and safety tips to visa requirements and cultural etiquette, travel insurance companies provide valuable resources to ensure that you are well-prepared and informed before embarking on your journey. This information can enhance your travel experience and help you avoid potential pitfalls.

Concierge Services

Some travel insurance policies include concierge services that can assist you in making reservations, booking tickets for events or attractions, and arranging transportation. These services can save you time and effort, making your travel experience more convenient and enjoyable. Whether you need assistance in securing a table at a popular restaurant or organizing a tour, the concierge is there to handle the logistics on your behalf.

Language Assistance and Translation Services

Traveling to a country where you don't speak the language can be challenging, especially when facing emergencies or trying to communicate with local authorities. Travel insurance often provides language assistance and translation services, helping you overcome language barriers and ensuring effective communication. This support can be vital in situations where clear communication is necessary, such as seeking medical help or reporting a theft.

Section 8: Coverage for Pre-Existing Conditions

Special Attention for Pre-Existing Medical Conditions

Unravel the options available for travelers with pre-existing medical conditions, as travel insurance can offer coverage and peace of mind for those who require special attention during their journeys. If you have a pre-existing condition, such as diabetes, asthma, or heart disease, travel insurance can provide coverage for any unexpected medical issues related to your condition. This ensures that you can access the necessary medical care without worrying about the potential financial burden.

Medical Evaluation and Exclusions

When it comes to pre-existing conditions, travel insurance policies may require a medical evaluation to assess your health status and determine the terms of coverage. It's important to disclose your pre-existing conditions honestly and accurately during the application process to ensure that you receive the appropriate coverage. Keep in mind that some policies may have exclusions or limitations for pre-existing conditions, so it's essential to review the policy details to understand the extent of coverage.

Emergency Medical Care and Assistance

In case of a medical emergency related to a pre-existing condition, travel insurance provides coverage for emergency medical care and assistance. This includes hospitalization, medications, and any necessary medical procedures. Additionally, travel insurance can also cover the costs of medical transportation back to your home country if it is deemed necessary for your health and well-being.

Section 9: Financial Protection and Trip Delay Coverage

Reimbursement for Trip Delays

Learn about the financial protection offered by travel insurance, including reimbursement for expenses incurred due to trip delays. Whether it's due to inclement weather, mechanical issues, or other unforeseen circumstances, trip delays can disrupt your travel plans and incur additional expenses. Travel insurance can provide reimbursement for reasonable expenses such as accommodations, meals, and transportation during the delay, ensuring that you can continue your journey comfortably and without incurring significant financial losses.

Coverage for Additional Accommodations

In the event of a trip delay, travel insurance may also cover the costs of additional accommodations if you are unable to reach your intended destination on time. This benefit ensures that you have a place to stay until your travel plans can be resumed or rearranged. It provides peace of mind, knowing that you won't be left stranded or forced to bear the financial burden of unexpected overnight stays.

Financial Reimbursement for Trip Cancellations

In addition to trip delays, travel insurance also offers financial reimbursement for trip cancellations. Life is unpredictable, and various circumstances can force you to cancel your travel plans before your departure date. Whether it's a personal emergency, illness, or other unforeseen events, travel insurance can cover the costs of non-refundable expenses such as flights, accommodations, and prepaid activities. This coverage protects your investment and ensures that you don't suffer significant financial losses due to circumstances beyond your control.

Section 10: Enhanced Travel Experience

Peace of Mind and Stress Reduction

Explore the ways in which travel insurance can enhance your overall travel experience, providing reassurance, convenience, and peace of mind throughout your journeys. Knowing that you are protected against various risks and challenges allows you to relax and fully immerse yourself in the experience. Travel insurance alleviates the stress and worry associated with unexpected events, enabling you to focus on enjoying your trip to the fullest.

Value for Money

While travel insurance requires an upfront investment, it offers a significant value for the coverage and benefits it provides. Considering the potential financial losses and risks associated with travel, having travel insurance is a cost-effective way to protect your investment and ensure that you are financially secure in case of unexpected events. It gives you the confidence to explore new destinations and try new experiences, knowing that you have the necessary protection in place.

Emergency Support Anywhere in the World

One of the greatest advantages of travel insurance is the global coverage it offers. Whether you're traveling to a remote island or a bustling city, travel insurance ensures that you have access to emergency support and assistance anywhere in the world. This comprehensive coverage allows you to venture off the beaten path and explore lesser-known destinations, knowing that you can rely on the support and services provided by your travel insurance policy.

In conclusion, travel insurance offers a comprehensive range of benefits that extend far beyond flight delays. From medical coverage abroad to emergency evacuation services, baggage protection, and enhanced travel experiences, travel insurance provides invaluable peace of mind and financial security during your adventures. Don't overlook the importance of travel insurance, as it can truly make a difference when the unexpected occurs.

0 Response to "Beyond Delays: The Full Spectrum of Benefits in Travel Insurance"

Post a Comment